the tax shelter aspect of a real estate syndicate

Thus investors cannot deduct their real estate losses from income. Your CPA or Tax advisor is the best person to.

Ws639 Why The Wealthy Invest In Real Estate With Jason Harris

Many people look to Real Estate Syndication for tax purposes.

. A tax shelter is a vehicle used by taxpayers to minimize or decrease their taxable incomes and therefore tax liabilities. The tax shelter aspect of real estate syndicates no longer exists. 32018683717 is located at 5706 E MOCKINGBIRD LN STE 115 DALLAS TX 75206.

Tax shelters can range from investments or. Resolving Problems Raised by the 1969 Act 29 NYU. See reviews photos directions phone numbers and more for Greater Dallas Real Estate.

Between 0 and 20 compared to traditional income which is taxed between 10 and 37. Limits taxpayers ability to use losses generated by real estate investments to offset income gained from other sources. The main thing to remember is that the IRS taxes capital gains at a rate ranging somewhere.

See reviews photos directions phone numbers and more for Greater Dallas Real Estate. Find company research competitor information contact details financial data for Greater Dallas Real Estate Investment Syndicate LLC of Dallas TX. True The tax laws prevent real estate investors from taking losses in excess of the actual amounts they invest.

Although it is easy to see that a registered offering partnership or arrangement having a significant purpose to avoid or evade federal income taxes is a tax shelter it is less. For purposes of section 448d3 a syndicate is a partnership or other entity other than a C. Your business qualifies as a.

The tax shelter aspect of real estate syndicates no longer exists. Under section 448d3 a taxpayer that is a syndicate is considered a tax shelter. They have passive activity gains and need a shelter.

GREATER DALLAS REAL ESTATE INVESTMENT SYNDICATE L Number. Reform of Real Estate Tax Shelters 7 U. Today real estate investors must use accelerated depreciation methods to recover thecosts.

The tax shelter aspect of real estate syndicates no longer exists. Get the latest business insights from Dun. Tion on Real Estate and its Recapture.

Resolving Problems Raised by the 1969 Act 29 NYU. California will maintain its.

:max_bytes(150000):strip_icc()/DDM_INV_REIT_final-c25e927cfd044ee79c56a6ddf1a6a696.jpg)

Real Estate Investment Trust Reit How They Work And How To Invest

How To Become A General Partner In A Real Estate Syndication Semi Retired Md

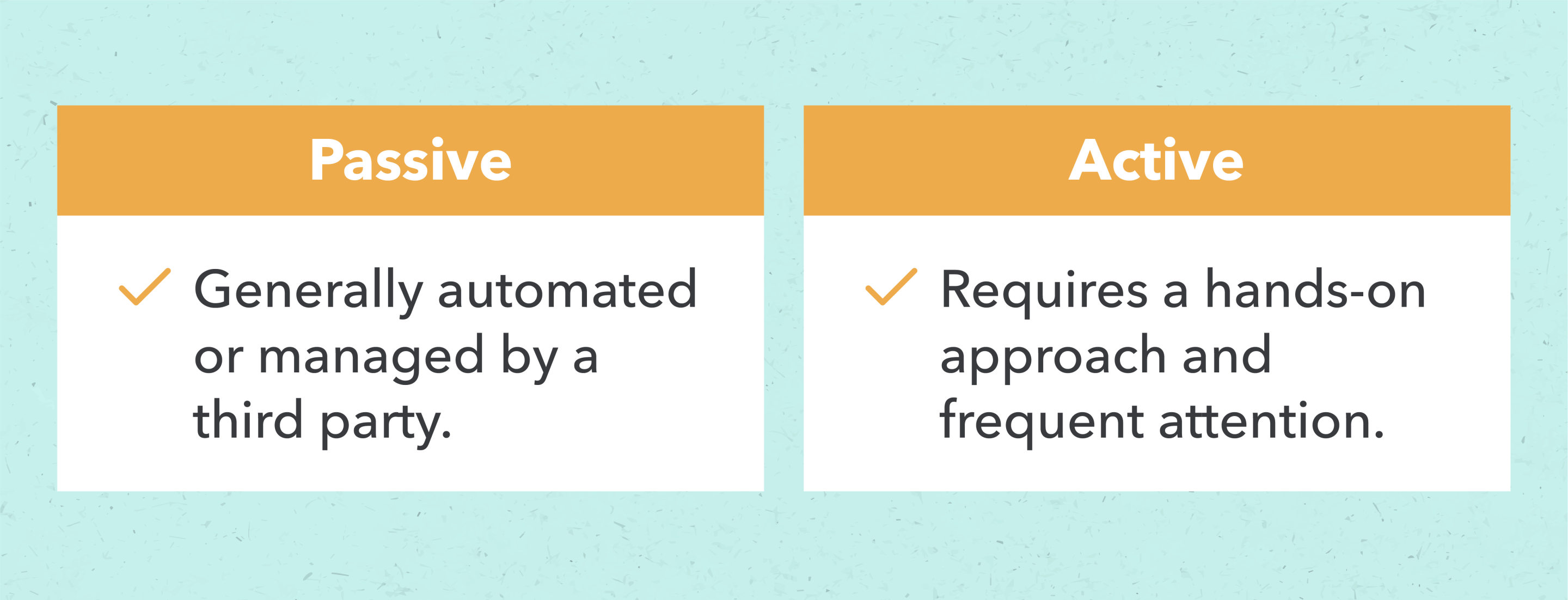

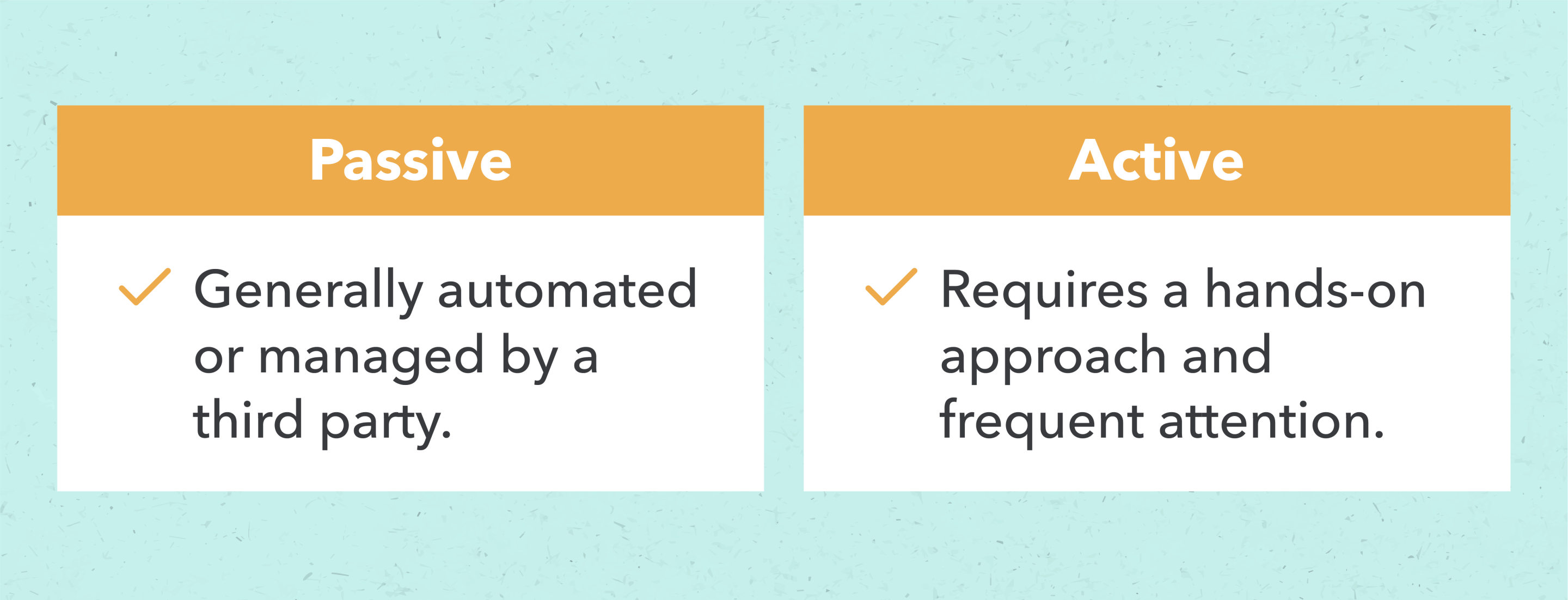

Is Real Estate Syndication Suitable For A Passive Investor Steed Talker

Passive Real Estate Investing Earn Passive Income Intuit Mint

Syn 01 How Real Estate Syndicate Fund Sponsors Gps Can Minimize Taxes Streamline Tax Filing

Tax Shelters For High W 2 Income Every Doctor Must Read This

U S Tax Havens Lure Wealthy Foreigners And Tainted Money Washington Post

6 Tax Benefits Of Investing In Real Estate Syndications

Real Estate Investors And Taxes Goodegg Investments

Wyoming Trusts Protected By Strong Privacy Laws Draw Global Elite Washington Post

What Is Real Estate Syndication Abcs Of Real Estate Syndication Investments For A Physician Investor

A Primer On Real Estate Professional Status For Doctors Semi Retired Md

Cash Accounting Method Unlocked Dallas Business Income Tax Services

Passive Real Estate Investing Earn Passive Income Intuit Mint

Why I Quit Buying Rental Properties To Buy Reits Instead Seeking Alpha

How To Structure A Real Estate Syndication Youtube

Cash Flow Appreciation Or Tax Shelter What Are Your Goals For Investing In Real Estate Syndications Smart Capital Llc

Evaluating The Sustainable Competitive Advantage Model For Corporate Real Estate Emerald Insight